M. A. Mian, December 10, 2015

NPV is a popular measure of profitability used in project/investment evaluation to assess potential profitability (in monetary terms) of the given projects/investments under consideration. Because of the time value of money, NPV takes into account the discounting of the net cash-flow (NCF) using a certain discount rate over the duration of the project. The discount rate is normally the minimum desired rate of return of the investor; also known as hurdle rate or threshold rate of return of the investor.

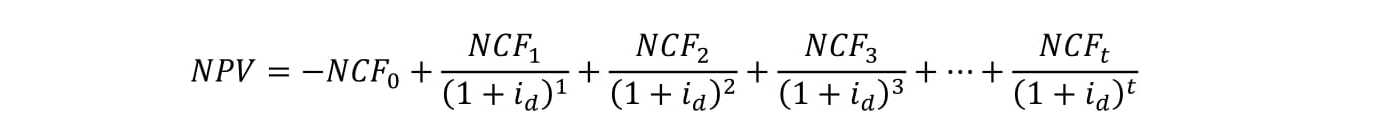

The following equation, used to calculate NPV, is typically shown in literature. This equation is supposed to assume that the investment (𝑁𝐶𝐹0) is at time zero and the rest of the cash-flows are at the end of each year.

The NPV calculated using the above equation is considered to be based on year-end cash-flow and year-end discounting assumption. However, this is not a correct assumption instead the above equation assumes beginning-of-the-year cash-flow and year-end discounting. NPV can be calculated using six different cash-flows and discounting assumptions.

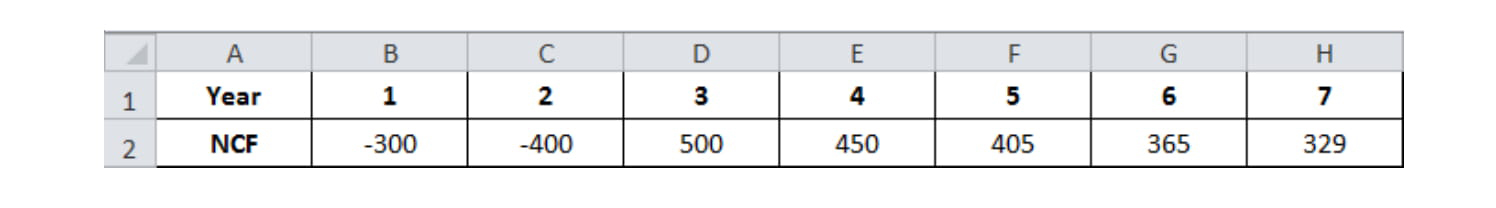

A project cash-flow is given in the following Excel cells. It is not possible to tell from these numbers if they are occurring at the (a) middle of the period, (b) end of the period or (c) beginning of the period. It is also not obvious if the discounting is taking place at the end of the period or middle of the period.

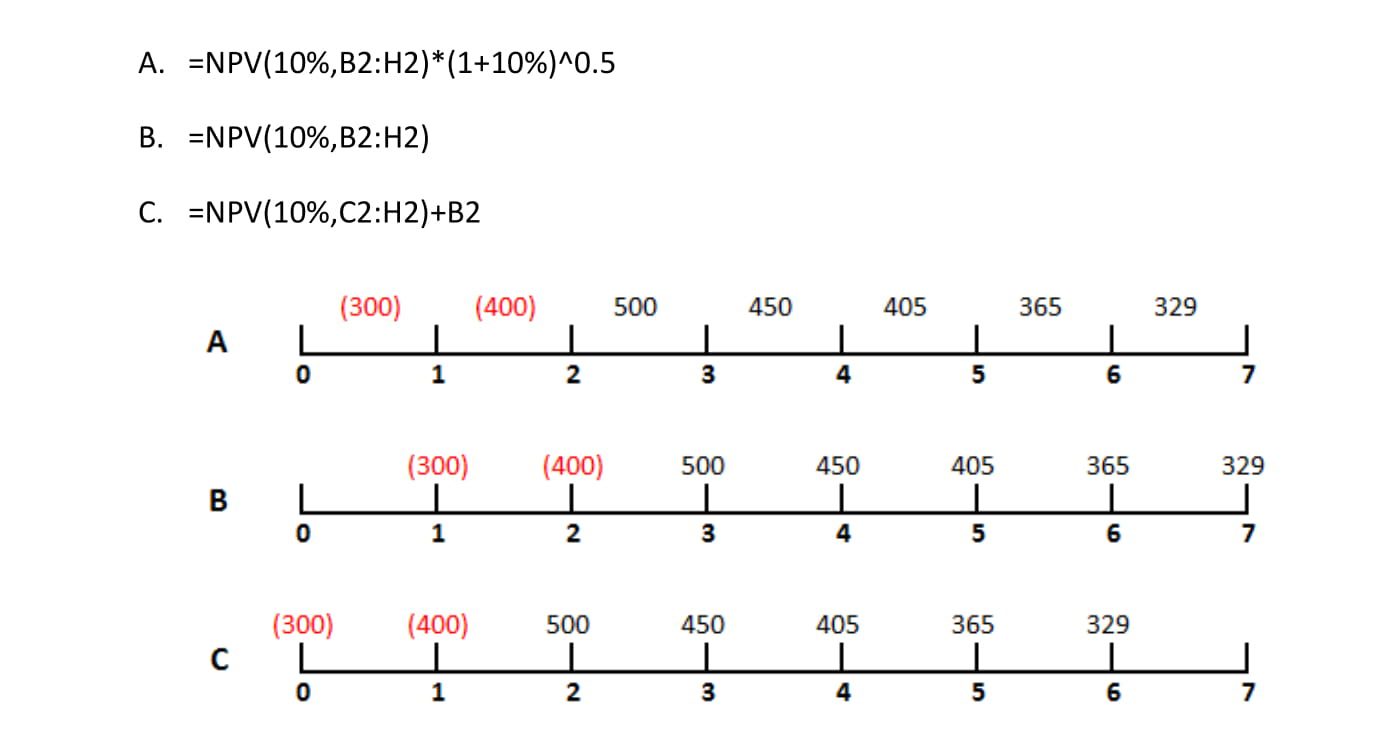

The most popular assumptions in the industry are:

A. Mid-year cash-flow and mid-year discounting – used by 90% of the companies

B. Year-end cash-flow and year-end discounting – used by 10% of the companies

C. Beginning of the year cash-flow and year-end discounting – used by many analysts thinking that they are using the year-end cash-flow and year-end discounting assumption.

These three assumptions are schematically shown below. The Excel’s NPV functions to calculate the NPV at 10% discount rate in each case are:

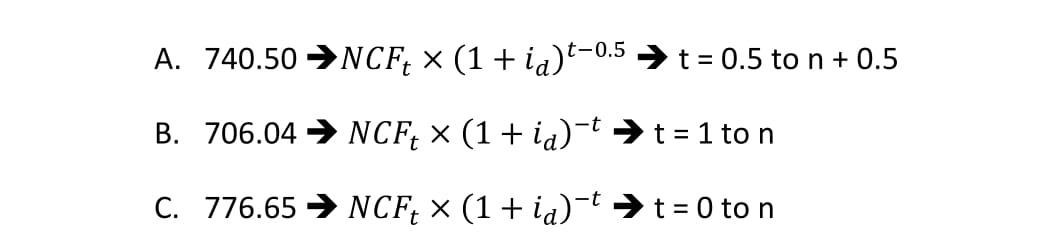

The above three Excel’s NPV functions result in the following three NPVs. The difference between A & B is 5% and the difference between B & C is 10%.

Consistently using any of the assumptions will result in the same decision. However, it is important that whichever assumption is used it should reflect the reality.

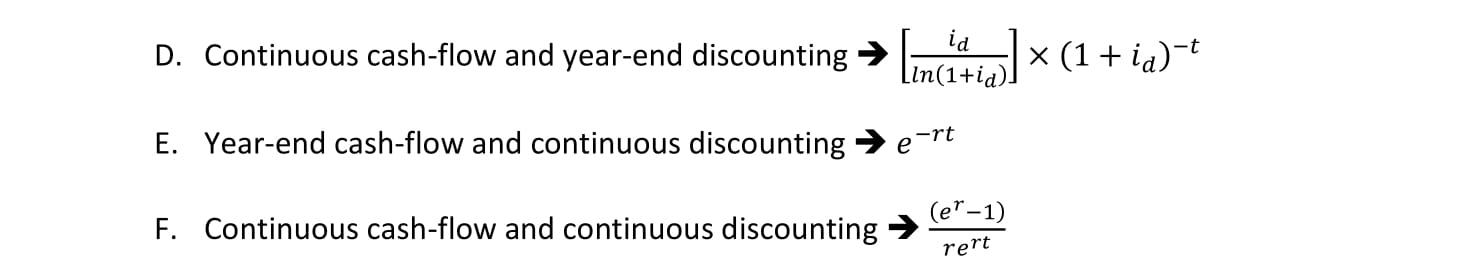

Given below are three more assumptions but they are rare. r is continuous discount rate, which is close to daily discounting.

These three assumptions result in additional three NPVs of 740.78, 682.45 and 717.74, respectively.